Three days later, just as he was about to start applying for jobs, he got an email from a high-net-worth individual expressing interest in the company. I remember leaving New York thinking this idea of me starting this company was never going to happen.” “About 30 minutes later he emailed me and said he had completely forgotten about lunch and was actually in the Hamptons.

After paying for the cross-country flight and “crashing” on his sister’s couch to save money, Kumar got up the next day and went to where they had arranged to have lunch. One potential investor, though, was still interested and asked Kumar to fly to New York so they could have lunch and talk more about the details. He recalls one of his lowest points came about six months after leaving his job and numerous failures seeking funding. I quickly realized I had better get comfortable with that.” “There’s a lot of excitement after you quit your job to be an entrepreneur - and then you go out to pitch your company and you get punched in the face about 8,000 times,” he says. It was 2014 before the naturally risk-averse Kumar felt confident enough to leave his job at Third Rock Ventures and become a full-time entrepreneur intent on using Lo’s model to build his new company. “We would sketch together something and email it to Andrew for feedback.” Lo told the two what needed to be changed, and from there the two began modeling what would eventually become BridgeBio (NASDAQ: BBIO), with Kumar as CEO. to 2 a.m., outlining what a company using Lo’s model could look like. He remembers Lo concluding the event by saying, “We have to get some people to step up and actually try this model.” Kumar and Stephenson simultaneously looked at each other as if to say, “Why not us?”Īfter that weekend, Kumar and Stephenson would meet and work until 1 a.m. “It was this unique collection of people, some from finance, some from biology, together with people from industry.” Kumar attended with longtime friend Brian Stephenson, Ph.D., (now CFO of BridgeBio). Not long afterward, Kumar attended CanceRx, a conference put on by Lo. Component number two was to structure the financing of these portfolios as combinations of equity and securitized debt (i.e., the process of packaging debts from several sources into a single security to be sold to investors) to access much larger sources of capital.Īfter reading the article, Kumar reached out to Lo, mentioning that he had taken his class some 10 years ago, and asked if he could stop by to talk about his paper. The first was the creation of a large, diversified portfolio (i.e., a $5 billion to $30 billion megafund) of biomedical projects at all stages of development. The article went on to propose an alternative funding model consisting of two components. He posited that biomedical innovation had become riskier, more expensive, and more difficult to finance with traditional sources. In a nutshell, Lo’s article noted that the process was broken for translating biomedical research into effective therapeutics. Kumar did so and even ended up taking a couple of the economics professor’s classes.

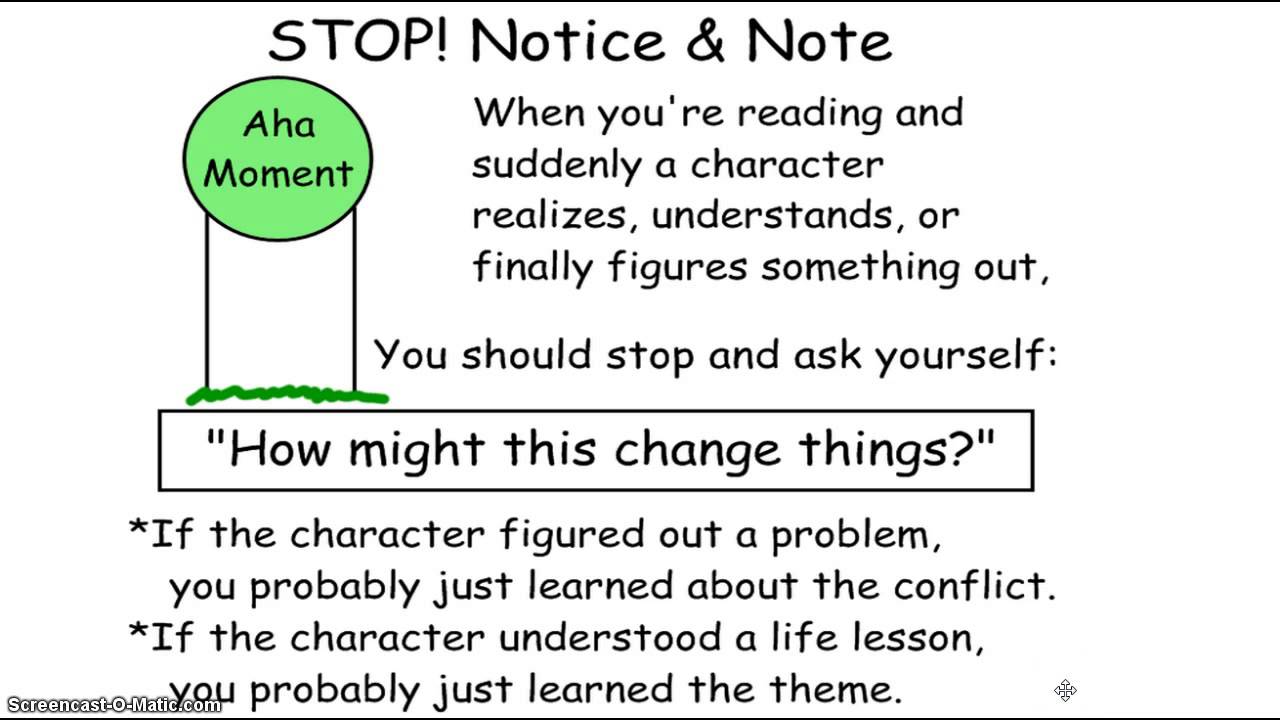

Aha moments note sheet how to#

He was trying to figure out how to model this, and everyone in the engineering school told him to go talk to Lo. at MIT in biomedical engineering, part of his thesis involved how cells metastasize and move. When Kumar began reading Lo’s article, “Commercializing Biomedical Research Through Securitization Techniques,” he first thought, “I know this guy.” A decade previous, while Kumar completed his Ph.D. AN ECONOMIST AND ENTREPRENEUR RECROSS PATHS This is the story of how Kumar set about to actualize Lo’s economic theories on drug discovery and development through the building of BridgeBio. It was after reading that article that Kumar experienced his eureka moment - and nothing would ever be the same for him. “So, the probability we could make a drug was higher, as was our understanding of disease, and yet we weren’t going after these for reasons that didn’t make sense to me as a scientist.” That’s when he came across an article in the October 2012 issue of Nature Biotechnology coauthored by Andrew Lo, Ph.D., an economics professor at MIT. In this role, he saw what seemed like a plethora of innovation just sitting on academic shelves - innovations that could potentially improve the lives of patients suffering from various diseases and ailments.Īccording to Kumar, scientific advancements had reduced complex biology problems to practical engineering problems. “It’s just that we were doing it so slowly,” he shares. In 2011 he was working as a principal at Third Rock Ventures building companies within the area of genetic medicine, a job that he felt was his passion. Life Science Leader - May 2021 FROM AHA MOMENT to $10 BILLION BIOPHARMAĮver have an aha moment? Then you can likely relate to the experience of Neil Kumar, Ph.D.

0 kommentar(er)

0 kommentar(er)